MultiChoice Group has announced details for the first time about its plans to restructure the shareholding in its main South African operation to facilitate the JSE-listed broadcaster’s sale to France’s Groupe Canal+.

The move comes 10 days after the two companies secured the green light from the Competition Tribunal for their transaction to proceed.

The merging parties have agreed to a special shareholding structure in South Africa to comply with South African legislation that prevents foreign entities from holding more than 20% of the voting rights in locally licensed broadcasters. Although the 20% restriction is likely to be lifted to 49% through proposed legislative changes, this could still take years.

MultiChoice said last month that the new structure for its South African operation will meet the requirements of “all applicable laws, including the restrictions on foreign ownership and control of South African broadcasting licences contained in the Electronic Communications Act (ECA)”.

“The structure includes MultiChoice (Pty) Ltd, the entity which contracts with South African subscribers, being carved out of MultiChoice Group and becoming an independent entity, majority owned and controlled by HDPs,” it said with reference to “historically disadvantaged persons”, a definition used in the ECA to deal with black economic empowerment rules.

“The reorganisation is specifically designed to ensure that the licensed entities within MultiChoice Group remain compliant with foreign control restrictions under the ECA, thereby preserving the integrity of the company’s broadcasting and signal distribution licences,” MultiChoice said on Monday.

As a result of the changes, MultiChoice South Africa will effectively be getting a range of new investors.

New shareholders

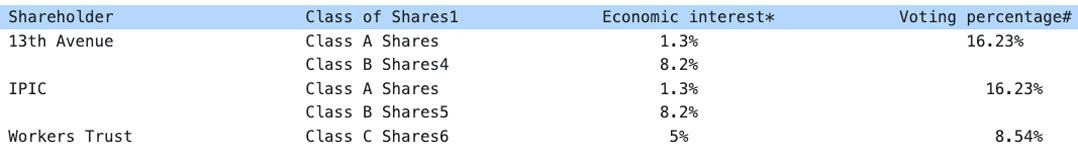

In recent days, MultiChoice, LicenceCo (created to host the new structure), Phuthuma Nathi Investments, 13th Ave Investments, Identity Partners Itai Consortium (IPIC) and the trustees of the MultiChoice Workers Trust have entered into several transaction agreements (including various subscription, repurchase and shareholders’ agreements) to give effect to the reorganisation.

- 13th Avenue is owned by investment vehicles associated with former Telkom CEO Sipho Maseko, Neo Lesela, Khanyisile Kweyama and Philiswe Sibiya.

- IPIC is owned by investment vehicles associated with Sonja De Bruyn, Maxwell Nyanteh, Taleleni Moshapo, Ernest Kwinda and Eugene Govender.

- Phuthuma Nathi is a listed broad-based black economic empowerment vehicle.

- The Workers Trust is a broad-based ownership scheme, the beneficiaries of which are employees of LicenceCo and employees of key suppliers of LicenceCo.

Upon implementation of the transactions, MultiChoice will hold 20% voting rights in LicenceCo ordinary shares and a 49% economic interest:

MultiChoice South Africa Holdings will soon declare an extraordinary dividend to its shareholders – Phuthuma Nathi and MultiChoice – of R1.375-billion, of which R343.75 million will go to Phuthuma Nathi. The payment of this dividend is subject to the implementation of the steps in the reorganisation.

Read: MultiChoice: We can’t afford to compete without help

“The net economic effect of the reorganisation for MultiChoice is that 26% of the economic interest in LicenceCo, the licensed broadcasting service provider that contracts with South African subscribers, will be disposed of, and 15% of the economic interest in Orbicom, the licensed signal distributor and holder of electronic communications and radio frequency spectrum licences, will be disposed of,” MultiChoice said. Under the plan, Phuthuma Nathi will increase its effective shareholding in Orbicom from 25% to 40%. – © 2025 NewsCentral Media

Get breaking news from TechCentral on WhatsApp. Sign up here.